Introduction

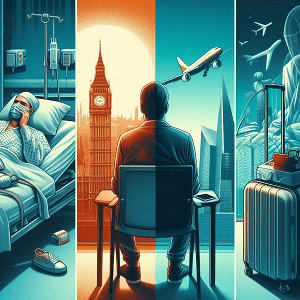

Traveling across the globe is the best pleasures in your life. The experience you gain while discovering a new city, wandering on a beach, or climbing through the mountains, are invaluable. However, every expedition has some element of risk and there travel insurance comes in. It’s the safety net for you and you feel glad to have it when things go wrong. In this article, we’ll go through everything you need to know about travel insurance so that you get well prepared for your next trip.

Definition?

Travel insurance is a type of insurance that covers your expenses and losses during your travel. From medical crises to travel cancellations, it provides you with a variety of coverage. Travel insurance ensure that you are not financially vulnerable when unforeseen events occur.

Types of Travel Insurance

There are four different types of insurance that cater to various travelers and travel styles.

Single-Trip Insurance

This type of coverage is ideal for those who travel alone. It protects a single traveler who travel seldom from beginning to end.

Annual Multi trip Insurance

If you are a frequent traveler who travel several times per year, this policy may be more cost-effective for you. It covers all of your trips throughout a 12-month period.

Insurance for Backpackers

This insurance is designed for long-term travelers, such as gap year students, and typically covers longer travels as well as adventure activities.

Cruise Insurance

Cruise-specific policies address hazards related to sailing, such as missed port departures and cruise-specific medical treatment. If you’re planning to travel on a cruise than check out our post on A Beginner’s Guide to Cruise Travel for tips to make the most of your cruise experience.

What does travel insurance cover?

The coverage offered needs to be understood because it is essential for making an informed decisions.

Medical emergencies.

One of the most important components, it covers medical treatment, hospital stays, and medical evacuation if necessary.

Trip Cancellation and Interruptions

This type of insurance will help you during illness, family emergencies, or other covered causes. This coverage will pay you for any pre-paid, or non-refundable charges.

Lost and Stolen Belongings

Holidays can be ruined if lose luggage or your possessions are stolen. This policy assists you in replacing lost items.

Personal liability

It protects you from property damage or injuries to others accidently caused by you. Personal liability insurance can shield you from high legal and compensation fees.

What Does it not cover?

While travel insurance provides extensive coverage, there are a few noticeable exceptions.

- Most policies do not cover pre-existing medical issues unless they are clearly stated in the policy.

- Skydiving, scuba diving, and bungee jumping are not covered unless you obtain supplementary coverage.

- Your insurance may not cover you if you travel to a country or region where there is a travel advice.

How to Select the Right Policy

Selecting the lowest option is not the best way to choose travel insurance. It requires more than then that:

- When you are selecting an insurance, first think about your health and the activities you are going to engage in. What is the worth of your belongings? This questions must be answered before selection of travel insurance.

- Compare several insurance agencies’ policies to understand what they cover and exclude.

- Understanding the terms and conditions, including exclusions and coverage restrictions. It is critical for preventing surprises later.

Understanding the Terms and Conditions

The language of the insurance policy might be complex, but it’s necessary to understand the terms and conditions of your policy:

- You need to know how much you will have to spend and what is the maximum payout.

- Every policy contains exclusions. Things that are not covered may help you decide whether to go for more coverage or not. Understand the claims process to ensure timely and accurate filing.

Use of Travel Insurance Effectively

To get the most of your travel insurance requires some planning:

- Always keep receipts, medical reports, and other paperwork that are required to file a claim.

- If an incident occurs contact your insurance company to start the claims procedure as soon as possible.

- Keep both digital and physical copies of your policy and emergency contact information. It might save you from lot of headache.

Common Misconceptions

There are numerous misinformation about travel insurance which can lead to poor decisions.

“No Need to Have a Travel Insurance”

Some travelers feel that nothing negative will happen to them. However, the unexpected can occur to everyone.

“My Insurance Company Covers Everything”

Not every incidence is covered. Understanding your policy’s restrictions is critical.

“My Credit Card Covers Me”

Although some credit cards provide travel insurance but it rarely covers as much as a standalone policy.

When Travel Insurance become Critical

Hearing about real-life circumstances helps emphasize the value of travel insurance.

Medical Emergency Abroad

During your journey if you become ill at a place where you do not speak the language. Travel insurance can cover medical expenditures and provide an interpreter.

Family Emergency.

Travel insurance will cover your pre-paid charges if a family member is unexpectedly becomes ill and you need to cancel your trip.

Lost Luggage Nightmare

What would happen if you lose your luggage when you arrive at your destination? It might ruin your trip but hold on! Travel insurance is here. They will let you replace necessary items so you can continue your travel.

Cost of Travel Insurance

Many factors can influence the cost of travel insurance. Understanding the cost is important for making an informed decision. Your age, trip duration, and the level of coverage you select all influence the cost of your policy.

Is it worth the investment?

Travel insurance might be a wise decision considering the possible costs of medical crises, vacation cancellations, and lost possessions.

Conclusion

At the end I would recommend any traveler who is planning for a vacation must have travel insurance. Knowing that if anything goes wrong, you’re covered, gives you a peace of mind. You can travel with confidence and enjoy your experience if you have travel insurance. However, it is important to know that what it covers, what it does not cover, and how to choose the correct policy.

FAQs

How can I file a claim for my travel insurance?

To file a claim, contact your insurance agents, provide them with necessary documents, and complete the relevant forms. It is critical to follow the procedures as indicated by your insurer to have a seamless process.

Is travel insurance required for domestic trips?

Although overseas travel have additional dangers but domestic visits might also be beneficial if you are booking expensive hotels or indulging in potentially risky activities.

Can I purchase travel insurance after I book my trip?

Yes, you can acquire travel insurance after you’ve booked your trip.